Beyond the Payout: CPFL's Blueprint for Sustainable Investor Value

Discover why CPFL Energia is more than a dividend headline. Explore its operational resilience and stable returns, anchoring portfolios amidst Brazil's dynamic energy sector.

Setting the Stage: More Than Just a Weekly Payout

When a company like (CPFE3) announces a dividend payment, such as the R$ 0.217 per share distributed on September 25, 2025, with a total value of R$ 250 million, it's easy to focus solely on the immediate financial gratification. For many investors, these payouts are a welcome addition to their portfolios, a tangible return on their capital. Yet, to truly understand the value proposition of a utility giant like CPFL, we must look beyond these singular announcements. What does a consistent dividend signal? It's often a testament to underlying operational stability and a predictable revenue stream, qualities that transform a seemingly 'boring' utility stock into a foundational asset for long-term, income-focused investors. Unlike the speculative highs and lows of growth stocks, CPFL's value lies in its steady hand, offering a beacon of reliability amidst market volatility. This isn't just about a weekly or quarterly payout; it's about a strategic blueprint for wealth preservation and consistent income generation that anchors a diversified investment strategy.

The Unsung Resilience of Energy Utilities: CPFL's Core Strength

The inherent strength of energy utilities often goes underappreciated in the rush for high-growth narratives. Companies like operate in a sector defined by consistent, non-discretionary demand. Electricity isn't a luxury; it's an essential service, powering homes, industries, and infrastructure, regardless of economic cycles. This fundamental characteristic grants utility providers a defensive quality, making them robust anchors during market downturns. CPFL, as a significant player in the energy landscape, benefits from this predictable demand, supported by a regulated environment that typically ensures stable revenue and profitability. Their operations span generation, transmission, and distribution, creating a vertically integrated model that enhances efficiency and reduces exposure to external shocks. This structural resilience, rather than fleeting market sentiment, forms the bedrock of CPFL's enduring appeal. It's this steady operational heartbeat that enables the company to consistently generate the cash flows necessary for sustained investor returns, year after year.

Deciphering Dividend Signals: CPFL's Approach to Investor Returns

Understanding CPFL's dividend strategy involves more than merely noting the R$ 0.217 per share distributed. It's about interpreting this as a deliberate signal from management regarding the company's financial health, capital allocation priorities, and unwavering commitment to its shareholders. For income-seeking investors, a consistent dividend schedule, like CPFL's, is a strong indicator of a mature, stable business with reliable cash flow generation. This isn't about chasing the highest yield, which can sometimes be a red flag, but rather about valuing consistency and predictability. CPFL's approach suggests a balanced strategy: retaining sufficient capital for necessary investments in infrastructure and growth while also rewarding shareholders. This balance is crucial for a utility, ensuring both the maintenance of existing assets and the expansion into new opportunities, all while maintaining a healthy payout ratio. It’s a testament to a company that understands its role as a foundational investment, providing a steady stream of income that can be reinvested or used to supplement an investor’s cash flow needs.

Powering Ahead: Navigating Brazil's Evolving Energy Landscape

energy sector is in constant flux, shaped by dynamic regulatory changes, an increasing focus on , and the imperative for grid modernization. For a company like , navigating this evolving landscape is key to sustaining its long-term value. The shift towards cleaner energy, for instance, presents both challenges and substantial opportunities for utilities with the foresight and capital to invest in solar, wind, and hydro projects. Likewise, the digitalization and modernization of energy grids are crucial for improving efficiency, reducing losses, and enhancing reliability, all of which directly impact profitability and customer satisfaction. CPFL's strategic positioning within this evolving environment is critical. Its capacity to adapt to new regulations, embrace technological advancements, and contribute to Brazil's energy transition will determine its continued success. For investors, this forward-looking posture, coupled with its inherent stability, suggests that CPFL is not just resting on its laurels but actively shaping its future, promising enduring value beyond today's headlines.

Related Articles

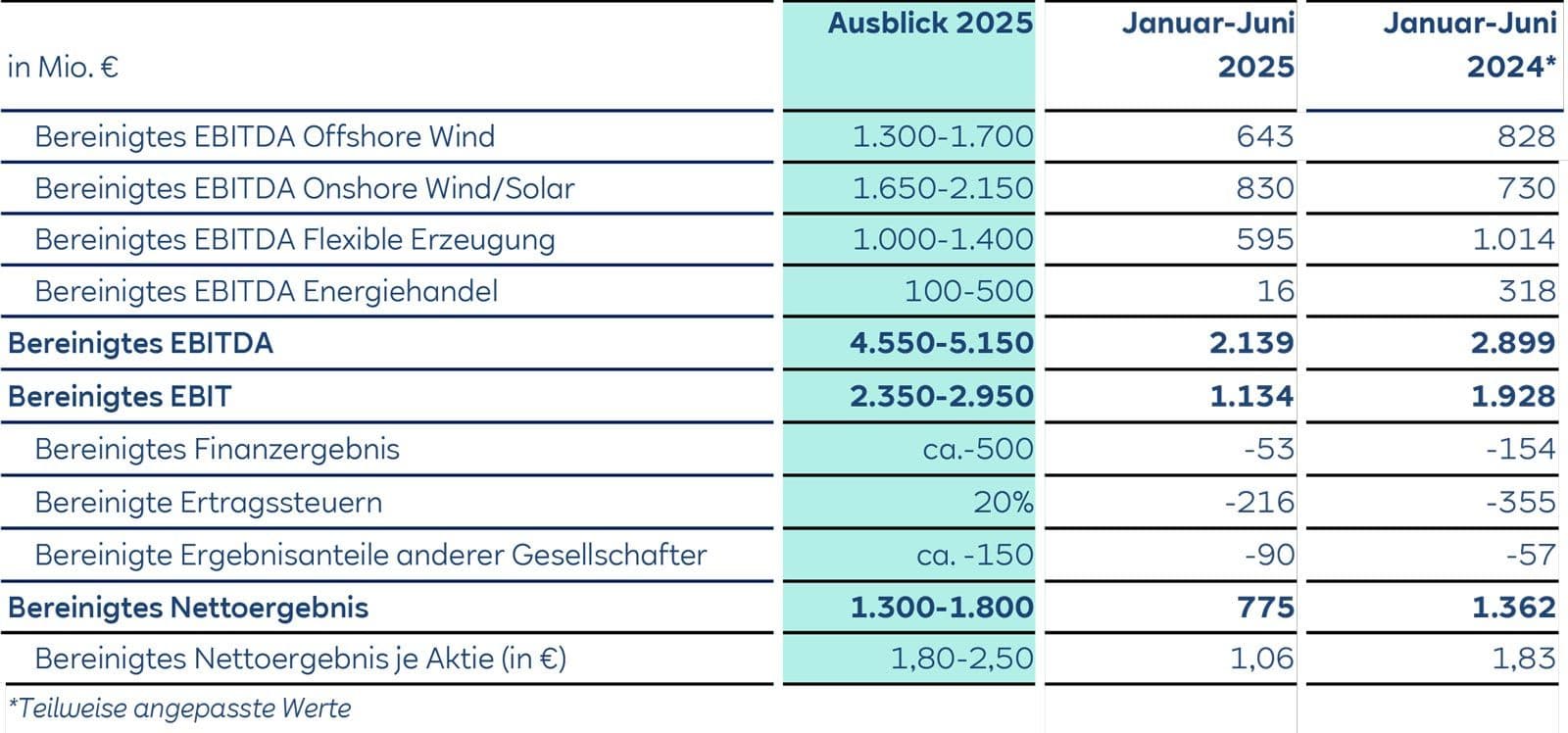

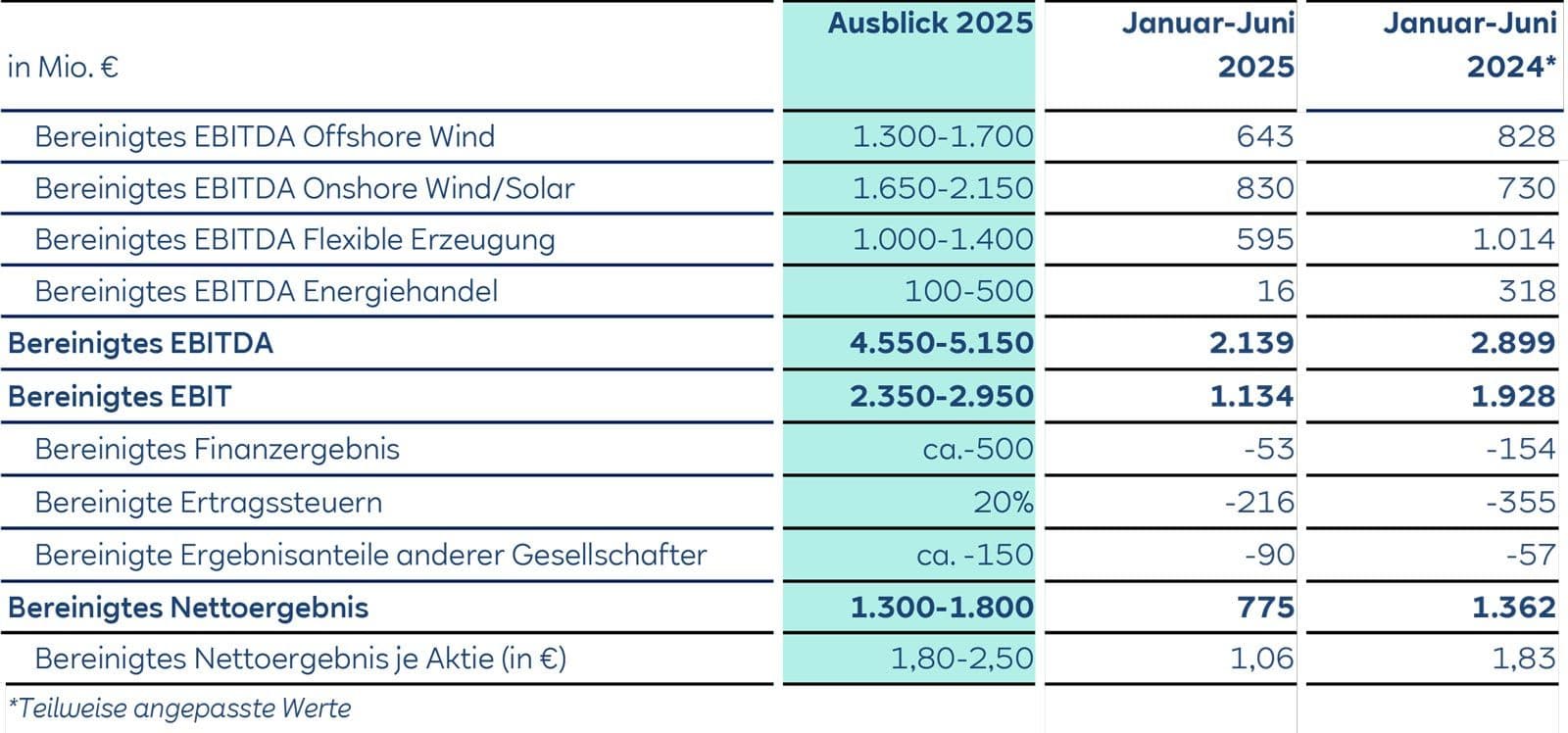

RWE's Strategic Current: Navigating Market Swings Towards a Greener Horizon

RWE's Strategic Current: Navigating Market Swings Towards a Greener Horizon

Beyond the R$1 Mark: Raízen's High-Stakes Bet on Strategic Revival

Beyond the R$1 Mark: Raízen's High-Stakes Bet on Strategic Revival

Nestlé's Balancing Act: Dividends, Dilemmas, and Disruption in a Shifting Market

Nestlé's Balancing Act: Dividends, Dilemmas, and Disruption in a Shifting Market

The Atlas Ascent: Unpacking Morocco's Quiet Rise as a Global Investment Frontier