Digital Foundations: How BIM is Rewriting the Rules of Real Estate Value and Investment Returns

Uncover how BIM reshapes real estate investment. Learn its power to de-risk projects, optimize asset value, and unlock significant financial returns in a digital era.

The Unseen Blueprint: Beyond Design to Financial Command

For too long, has been pigeonholed as a sophisticated design and construction tool, primarily the domain of architects and engineers. Yet, to truly grasp its revolutionary potential, we must look past the visual aesthetics and structural integrity, and delve into its profound financial implications. BIM is not just a digital drawing board; it's a dynamic, data-rich repository that transforms a building project from a collection of blueprints into a living financial model. Imagine having real-time access to cost estimates, material quantities, scheduling impacts, and even potential energy consumption, all integrated within a single, coherent virtual representation of your asset. This 'unseen blueprint' provides stakeholders – from developers to investors – with an unprecedented level of financial command, enabling proactive decision-making, meticulous budget allocation, and the ability to conduct intricate scenario planning long before a single shovel breaks ground. It's about quantifying value and optimizing capital deployment with a precision previously unattainable, fundamentally shifting how we perceive and manage real estate investments.

De-risking the Concrete Jungle: BIM's Shield Against Investment Volatility

The real estate sector, with its substantial capital outlays and protracted timelines, has historically been fraught with financial uncertainties. Cost overruns, schedule delays, and unforeseen complications are not just headaches; they erode investor confidence and diminish returns. This is precisely where BIM emerges as a powerful de-risking mechanism, offering a crucial shield against investment volatility. By fostering unprecedented collaboration and transparency among all project participants, BIM significantly reduces errors and rework through advanced clash detection and visualization. It provides a single source of truth for all project data, minimizing miscommunication and disputes that often plague complex developments. Investors gain clear visibility into project progress, budget adherence, and potential roadblocks, allowing for timely interventions. This proactive risk management, facilitated by BIM's comprehensive data, translates directly into more predictable project outcomes, tighter budget control, and ultimately, a more secure and attractive investment proposition in the inherently unpredictable 'concrete jungle'.

The Lifecycle Dividend: How Digital Twins Drive Long-Term Asset Value

While BIM’s impact during design and construction is undeniable, its true long-term financial dividend becomes apparent through the concept of the . A digital twin, essentially a live, continuously updated virtual replica of a physical asset, is born from the rich data embedded within a BIM model. As a building transitions from construction to operation, this digital twin becomes an invaluable asset for facility management, maintenance, and strategic planning. It allows asset owners to monitor performance in real-time, predict equipment failures, optimize energy consumption, and schedule maintenance proactively rather than reactively. This intelligent oversight extends the lifespan of critical systems, reduces operational costs, and enhances tenant satisfaction by ensuring optimal building performance. The continuous feedback loop from the physical asset back into its digital twin enables perpetual optimization, ensuring the property remains efficient, sustainable, and highly valuable throughout its entire lifecycle, far beyond the initial build.

Financing Tomorrow's Skyscrapers: BIM as the New Investor Language

In an increasingly competitive capital market, securing financing for ambitious real estate projects demands more than just a compelling vision; it requires verifiable data and transparent projections. BIM is rapidly becoming the new investor language, offering a standardized, data-rich framework that speaks directly to the financial concerns of lenders and equity partners. Imagine presenting a project where every component, every material, and every construction phase is meticulously documented within a 3D model, linked to costs, schedules, and performance metrics. This level of detail and transparency significantly streamlines the due diligence process for financial institutions, allowing them to assess risk and potential returns with greater accuracy and confidence. Projects underpinned by robust BIM data are perceived as less risky, more efficiently managed, and ultimately, more likely to succeed. This enhanced clarity can lead to more favorable financing terms, quicker capital deployment, and a competitive edge when vying for investment, effectively translating complex architectural plans into a clear, understandable financial narrative.

The Intelligent Asset: Where BIM Meets AI and the Future of Property

The evolution of BIM doesn't stop at digital twins; its most transformative impact lies in its convergence with and machine learning. This powerful synergy is giving birth to truly 'intelligent assets' – buildings that can learn, adapt, and optimize their performance autonomously. BIM models provide the foundational data structure, a detailed map of the building's physical and functional characteristics, while AI algorithms analyze this data in real-time, identifying patterns, predicting future needs, and making informed decisions. Think of AI-driven systems optimizing HVAC based on occupancy patterns and external weather, or predicting maintenance needs for specific equipment before a failure occurs. This integration promises unprecedented levels of efficiency, sustainability, and personalization for occupants. As BIM becomes the central data hub for these AI-powered systems, the future of property management will be defined by self-optimizing buildings that not only reduce operational costs but also create dynamic, responsive environments that significantly enhance asset value and investment appeal.

Related Articles

The Unseen Architects: How Physical Presence Grounds Blackstone's Digital Empire

The Unseen Architects: How Physical Presence Grounds Blackstone's Digital Empire

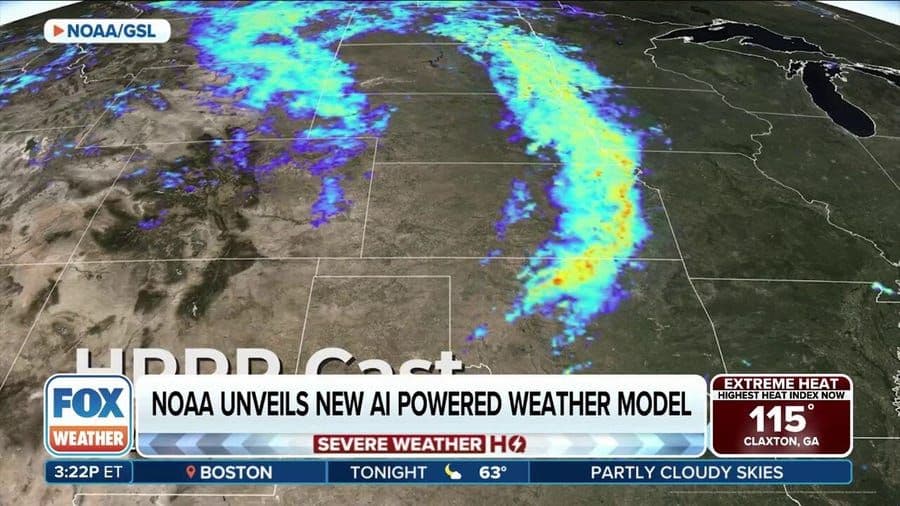

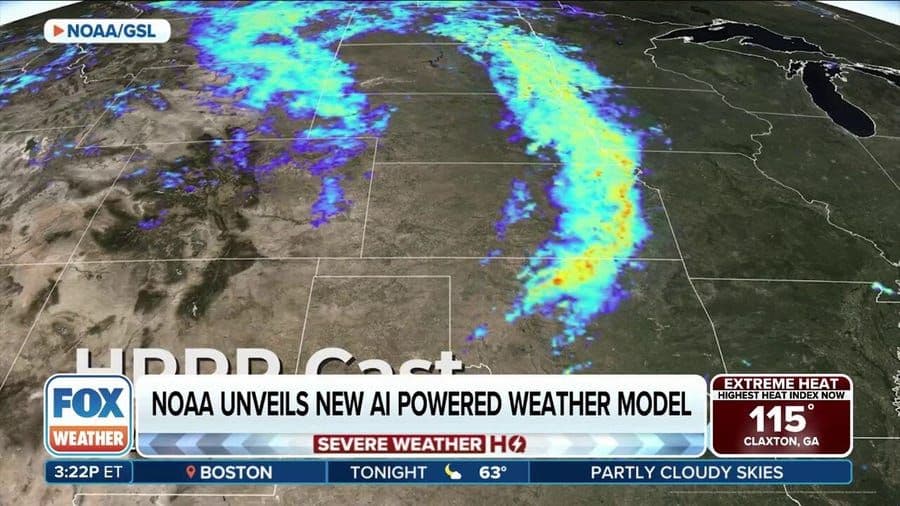

Atmosphere Unlocked: The Global AI Pursuit Reshaping Our Weather World

Atmosphere Unlocked: The Global AI Pursuit Reshaping Our Weather World

The Algorithm of Growth: Hyulim Robot and Korea's AI Industrial Revolution

The Algorithm of Growth: Hyulim Robot and Korea's AI Industrial Revolution

The Algorithm Meets the Anchor: How BNN Bloomberg is Redefining Financial News for the Digital Age