The Unseen Forces Shaping Your Steak: A Global Price Odyssey

Uncover the real forces behind beef prices: trade wars, data debates, and government policies. A deep dive into the complex economics shaping your dinner plate.

The Great Beef Divide: Unpacking the Price Paradox

Imagine a world where the price of a kilogram of beef in a neighboring country within the same economic union is reported to be more than double what official statistics suggest. This isn't a hypothetical scenario; it's the very paradox that recently captivated consumers and policymakers in and . , through its subsidiary , initially claimed beef in Russia retailed for over 10,000 tenge per kilogram. This figure stood in stark contrast to , which reported an average price closer to 4,271 tenge. The discrepancy immediately sparked questions and doubts among the Kazakh public. How could such a significant difference exist, and which figure truly reflected reality? The answer, as it often is with complex economic data, lies in the nuances of definition and methodology, setting the stage for a deeper look into what truly drives meat prices across borders.

Quality, Quantity, and Quotas: The Complex Calculus of Meat Costs

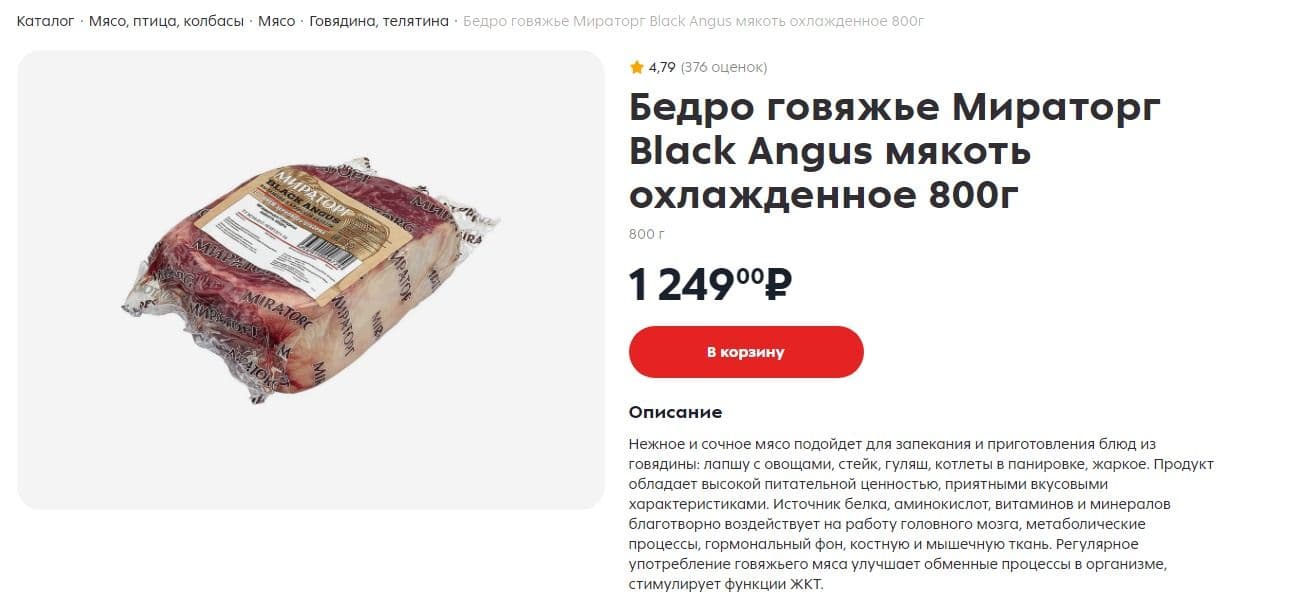

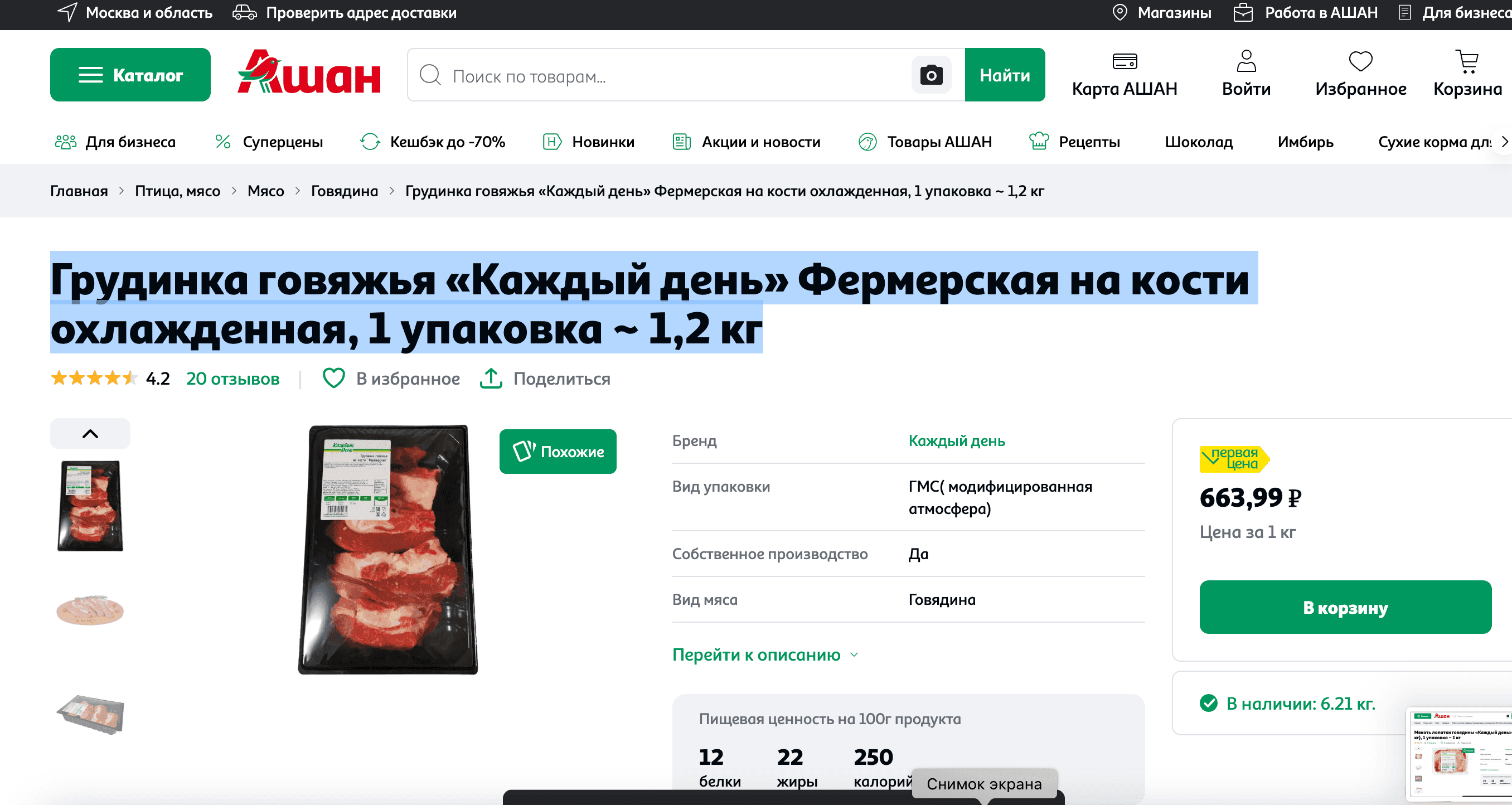

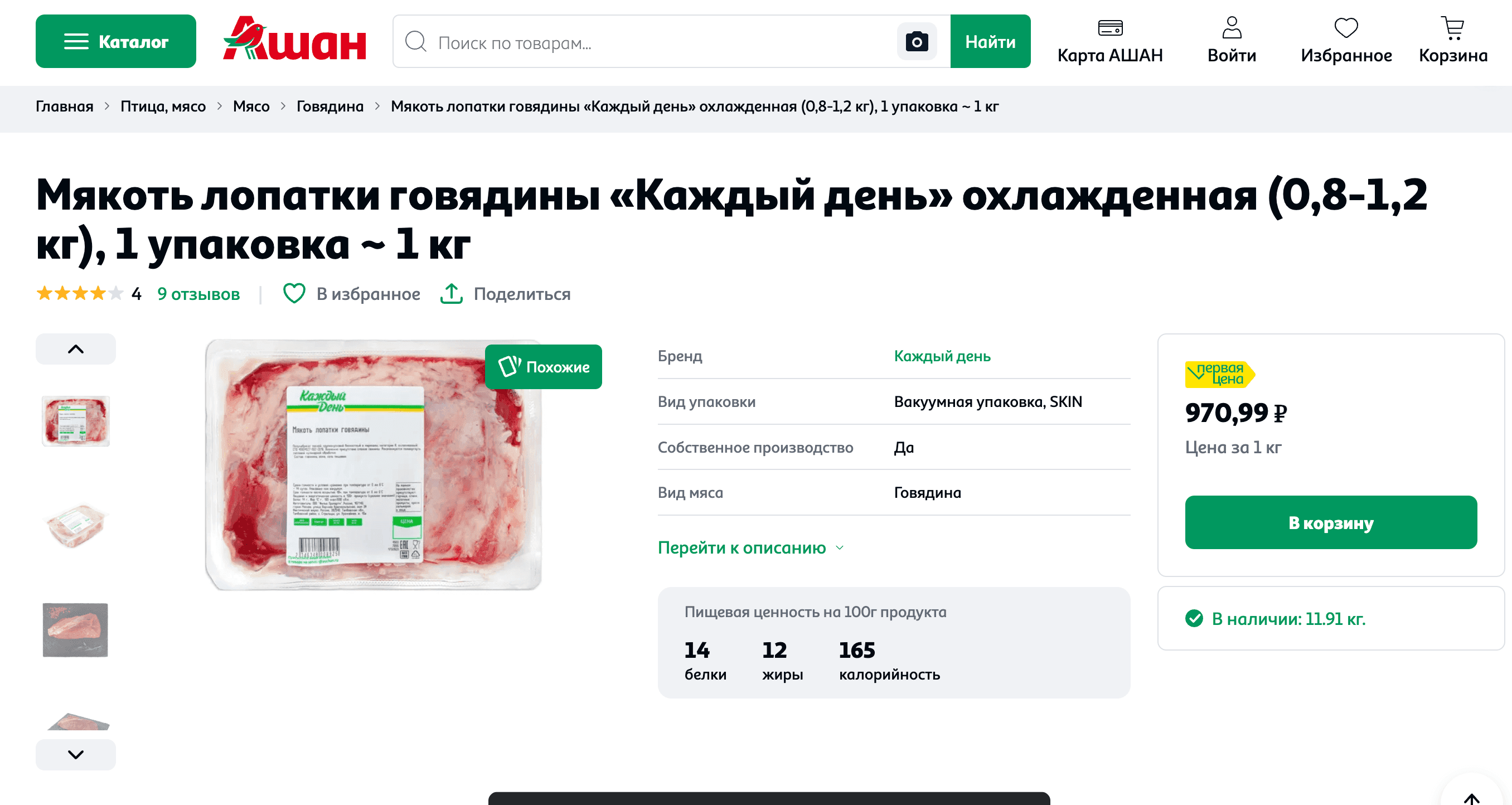

The seeming price paradox quickly revealed itself to be a complex interplay of product quality and data collection methods. clarified that their higher Russian price wasn't an average but a specific retail observation: 1,249 rubles for 800 grams of premium in the 'Pyaterochka' supermarket chain, translating to over 10,000 tenge per kilogram. In , their comparison point was standard brisket and shoulder cuts in 'Magnum' supermarkets, priced at 4,715 tenge. The rationale from for choosing premium was that it was the 'cheapest option' found at the time of their analysis in , a claim that itself raises eyebrows. This highlights the inherent challenge in comparing 'like-for-like' across markets, where cuts, breeds, and even retail environments fundamentally alter value. Beyond quality, governmental policies also shape this calculus, with implementing measures like export bans on live cattle and quotas for meat processors to ensure domestic supply and stabilize prices.

When Data Doesn't Align: Lessons from the Russia-Kazakhstan Beef Debate

The conflicting beef price reports between and offer a compelling lesson in the perils of data interpretation and the importance of methodological transparency. While presented a national average for beef (excluding boneless meat), focused on specific, high-end retail offerings. This divergence isn't merely academic; it has real-world implications for public perception, trade policy, and consumer confidence. Minister noted that the shoulder-brisket part of beef, a regulated staple, was a primary driver of inflation in , making it an attractive export commodity to neighboring countries. Indeed, Minister revealed a dramatic increase in meat exports, from 11,000 tons in 2024 to nearly 40,000 tons (including live cattle) in 2025. Such a surge underscores the market pressures at play and how a seemingly stable domestic price can make local products highly appealing to external markets, further complicating efforts to maintain domestic supply and price stability.

Stewarding the Steak: Government's Role in Market Stability

The beef price debate ultimately funnels into the critical role governments play in stewarding market stability, especially for essential commodities. In response to rising prices and increased exports, has deployed a multifaceted strategy. They've banned live cattle exports, tightened veterinary control over meat shipments, and set export quotas exclusively for meat processing companies. More proactively, they've forged agreements with retail chains to source meat directly from farmers, aiming to cut out unproductive intermediaries that inflate prices. Looking ahead, the , in collaboration with , plans to launch an agro-marketplace by year-end. This digital platform is designed to connect producers, retail networks, and social-entrepreneurial corporations directly, fostering greater transparency and efficiency in the supply chain. These decisive actions, alongside launching a public hotline for beef market inquiries, demonstrate a concerted effort to balance domestic supply, manage inflation, and ensure consumer access to affordable meat.

Related Articles

The Great Meat Debate: Reconciling Paraguay's Export Prowess with Local Plates

The Great Meat Debate: Reconciling Paraguay's Export Prowess with Local Plates

Pakistan's Paradoxical Plate: When Global Demand Meets Local Deception

Pakistan's Paradoxical Plate: When Global Demand Meets Local Deception

The Farmhouse Files: Unraveling Islamabad's Disturbing Illicit Meat Network

The Farmhouse Files: Unraveling Islamabad's Disturbing Illicit Meat Network

The Pampas Paradox: Unraveling Argentina's Turbulent Agricultural Destiny