From Bricks to Balance: The Overlooked Economic Roots of True Well-being

Discover how stable housing and robust finances form the true foundation of well-being. Uncover practical insights to build lasting personal and economic peace of mind.

Beyond the Buzzword: Re-evaluating Modern Well-being

In an era saturated with 'wellness' trends and self-care mantras, the true essence of well-being, or bienestar, often gets lost amidst superficial interpretations. We're encouraged to seek mindfulness, balanced diets, and regular exercise – all undeniably beneficial. Yet, this narrative frequently overlooks the bedrock upon which genuine, sustainable well-being is built: tangible economic security. Consider the daily anxieties that plague countless individuals: the struggle to afford a decent home, the fear of unexpected expenses, or the precariousness of fluctuating markets. These aren't minor inconveniences; they are fundamental stressors that erode mental and physical health, making any pursuit of 'inner peace' a Sisyphean task. Our understanding of well-being needs a recalibration, shifting focus from merely coping with stress to proactively building environments where stress is minimized. When we examine economic indicators, from national housing policies to the stability of a currency like the against the , we begin to see the profound, often invisible, economic threads that weave through every aspect of our lives, dictating our capacity for true bienestar. It's time to acknowledge that a balanced life isn't just about what's inside us, but also about the stability of the ground beneath our feet.

Housing as the Cornerstone: Building a Secure Foundation for Life

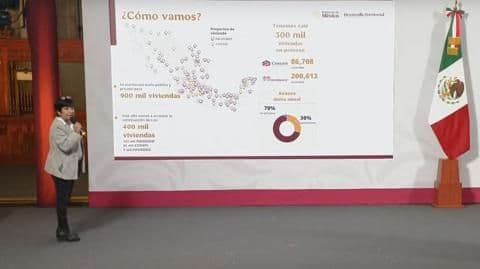

A stable home is far more than just shelter; it's the primary anchor for personal and familial well-being. Without a secure, affordable place to live, the very concept of bienestar becomes a distant dream. Imagine the emotional toll of constantly worrying about rent, or the instability of living in an inadequate space. This is precisely why accessible housing isn't just a social issue, but a critical economic one. Government initiatives, like those from in , are recognizing this fundamental link. There's an ambitious goal to construct 1.8 million homes this sexenio, with 400,000 underway this year alone, and a significant land reserve already secured for 900,000 more units. These aren't just numbers; they represent the potential for hundreds of thousands of families to gain the stability needed to thrive. The push for urban densification and accessible housing aims to counter market speculation and ensure that a foundational element of life is within reach, transforming the aspiration of moving out on your own from a financial tightrope walk into an achievable milestone for more people.

Financial Resilience: Fueling Peace of Mind in an Uncertain World

Beyond the physical security of a home, financial resilience acts as the indispensable fuel for sustained peace of mind. In a world characterized by economic volatility, demonstrated by events like the 's fall against the due to international concerns, personal financial stability isn't a luxury – it’s a necessity. Think about the stress of unexpected expenses or the anxiety of a fluctuating income. These aren't merely abstract economic concepts; they translate directly into sleepless nights and diminished quality of life. Cultivating robust personal finances means more than just budgeting; it involves strategic planning, understanding market dynamics, and crucially, safeguarding one's assets. The importance of protecting bank accounts and personal data, especially in an increasingly digital world, cannot be overstated. When economic models, such as those outlined for 2026, prioritize strengthening infrastructure and societal well-being, they implicitly acknowledge that a stable macroeconomic environment is vital for individuals to build their financial safety nets. This proactive approach to financial health empowers individuals to navigate life's inevitable uncertainties with greater confidence, fostering a deep sense of security that underpins true well-being.

Policy, Progress, and the Collective Good: Shaping Societal Well-being

The individual pursuit of well-being is undeniably important, but its ultimate achievement is deeply intertwined with broader societal structures and governmental policies. No matter how diligently one manages personal finances or seeks stable housing, systemic barriers can undermine these efforts. This is where the power of policy comes into play, shaping an environment where collective bienestar can flourish. Consider the ambitious housing goals set by , aiming to deliver 9,160 social interest homes by the end of 2025, contributing to a sexennial target of 1.8 million new residences. These initiatives, alongside strategies for urban densification and accessible housing, are not just about construction; they are about consciously engineering a society with stronger foundations. When political leaders, like , articulate economic models that explicitly prioritize strengthening infrastructure and well-being, it signals a recognition that public investment in these areas yields profound returns in human flourishing. Such policies create the necessary conditions for individuals to build secure lives, fostering a ripple effect of stability and peace of mind across communities, proving that collective progress is the most potent catalyst for individual well-being.

Cultivating Your Own Ecosystem of Well-being: Actionable Insights for Stability

Understanding the economic roots of bienestar isn't just an academic exercise; it's a call to action for cultivating a personal ecosystem of stability. While policy shapes the landscape, individual choices within that landscape are paramount. Start by mastering personal financial planning, especially for significant life transitions like renting for the first time. This means not just tracking expenses, but building emergency funds and understanding the implications of broader economic shifts, like currency fluctuations. Proactive engagement with financial literacy empowers you to protect your assets and data against threats, ensuring your digital and monetary security. On the housing front, stay informed about government programs and urban development initiatives that aim to increase accessibility. Advocating for policies that support affordable housing and responsible urban growth directly contributes to a more stable environment for everyone. Ultimately, true well-being isn't about ignoring financial realities, but about integrating economic prudence into your life's blueprint. By actively building your financial resilience and understanding the housing market, you're not just surviving; you're building a foundation robust enough to support a truly balanced and fulfilling life, irrespective of external buzzwords.

Related Articles

The Daily Dial: Decoding the Earth's Shifting Moods in Your Local Forecast

The Daily Dial: Decoding the Earth's Shifting Moods in Your Local Forecast

The Empowered Payout: A Strategic Guide to Sence's Key Worker Benefits

The Empowered Payout: A Strategic Guide to Sence's Key Worker Benefits

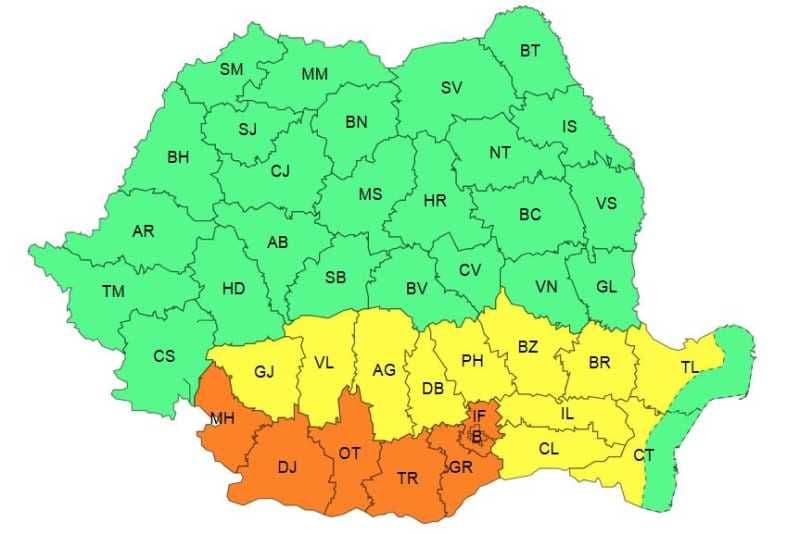

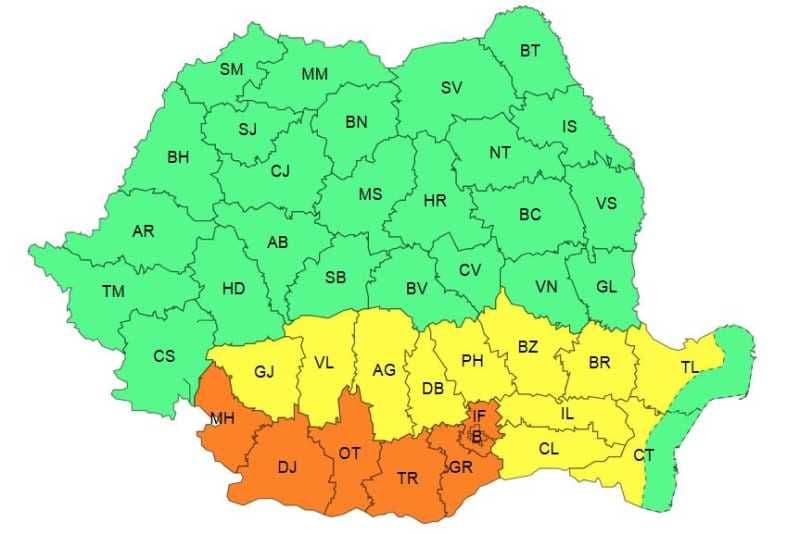

Beyond Asphalt and Pipes: Anghel Saligny, The Unseen Architect of Rural Romanian Revival

Beyond Asphalt and Pipes: Anghel Saligny, The Unseen Architect of Rural Romanian Revival

Peru's Retirement Roulette: Balancing Urgent Demands with a Vanishing Future