Peru's Retirement Roulette: Balancing Urgent Demands with a Vanishing Future

Peru faces a pension crisis. Explore the tug-of-war between urgent withdrawals and long-term security, as political decisions clash with expert warnings about a vanishing retirement future.

The Allure of Quick Cash: A Nation's Retirement Dilemma

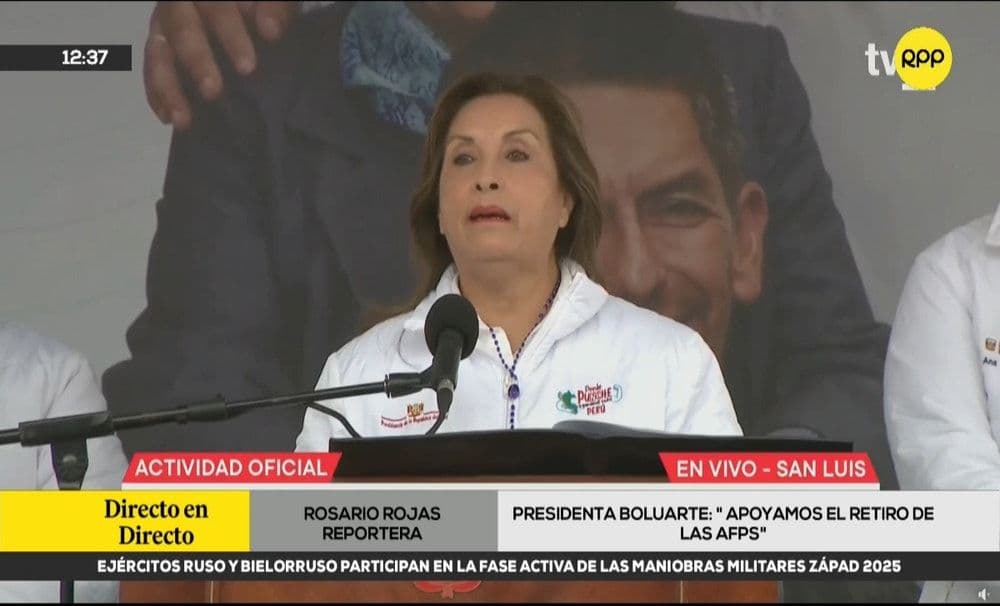

Peru finds itself at a critical juncture, grappling with a deeply conflicted vision for its citizens' financial future. The promise of immediate relief, often in the form of accessing personal pension funds, holds an undeniable allure for a populace navigating economic uncertainties. President 's recent announcement, signaling her government's favorable opinion on an eighth withdrawal from the private pension funds (AFP), perfectly encapsulates this tension. She framed it as empowering families, declaring, "The money that is discounted from all workers and goes to the AFPs or the ONP, is the money of the working family. And if that money belongs to the working family, then the family must know when it needs it and how it uses it for the good of its family." This stance, while resonating with many, stands in stark contrast to the warnings from financial experts. Indeed, the very notion of an eighth withdrawal follows a pattern of previous instances that have already left millions with nothing saved for their golden years. The public's demand for these withdrawals, often fueled by desperation, has become a powerful political force, setting the stage for a dramatic clash between short-term appeasement and long-term stability.

The Central Bank's Sobering Forecast: Long-Term Well-being at Risk

While the immediate appeal of unlocking pension funds is clear, has issued a stark, unequivocal warning: an eighth AFP withdrawal would severely undermine the long-term well-being of the population. , the BCRP's central manager of Economic Studies, articulated this concern, explaining that such a move directly contradicts the fundamental need for establishing robust provisional savings for the future. His assessment isn't merely theoretical; it's grounded in a grim reality. The previous seven withdrawals have already resulted in a staggering 2.3 million Peruvians having absolutely zero retirement savings. This isn't just an abstract economic statistic; it represents millions of individuals facing a bleak and insecure future, potentially becoming a significant burden on state resources. The BCRP's message is a clear call for prudence, urging leaders to look beyond the immediate political horizon and consider the profound, irreversible damage that continued depletion of pension funds will inflict on the nation's collective retirement security.

Political Winds and Policy Fault Lines: A Divided Government's Stance

The political landscape surrounding pension system is rife with contradictions, showcasing a government seemingly at odds with itself. President 's public endorsement of an eighth AFP withdrawal, presented as a coordinated decision with the Minister of Economy and Finance, starkly contrasts with Minister 's earlier, emphatic rejection of such a measure. Pérez Reyes had previously stated that his ministry was against further withdrawals following the approval of the pension system reform's regulations, suggesting the law no longer provided for them. This discrepancy reveals deep fault lines within the executive branch, where political expediency appears to be wrestling with economic prudence. Boluarte, while advocating for withdrawals, simultaneously urged citizens to evaluate their personal situations "with responsibility and also thinking about that future retirement." Such rhetoric, attempting to balance immediate gratification with long-term responsibility, highlights the precarious tightrope walk undertaken by leaders caught between popular demand and expert warnings, leaving many to wonder which voice truly guides policy.

Beyond the Ballot Box: Public Outcry and the Future of Pension Reform

The government's internal debates and expert warnings are not happening in a vacuum; they are met with a palpable public outcry that transcends mere calls for withdrawals. Recent mobilizations, spearheaded by groups like the , saw hundreds protesting in central and other major cities like Piura, Trujillo, and Puno. These weren't just demonstrations; they were passionate rejections of the recently approved pension reform regulations themselves, leading to clashes with police, injuries, and arrests. The protestors' demands extend far beyond simply accessing their funds; they seek fundamental changes, including the total derogation of withdrawal prohibitions, the elimination of automatic affiliation to the private system, and a re-evaluation of the increased age for early retirement. This widespread dissent signals a profound dissatisfaction with the entire structure and fairness of the pension system, demanding a comprehensive overhaul that truly addresses the needs and aspirations of the working population, rather than just offering temporary financial fixes.

Rebuilding the Nest Egg: Strategies for a Sustainable Pension Future

The ongoing pension crisis in underscores an urgent need for strategies that can rebuild trust and ensure a sustainable retirement future for all. With millions already having depleted their savings, the path forward cannot simply involve more withdrawals. Instead, it requires a multifaceted approach that prioritizes long-term financial security while acknowledging immediate economic realities. One critical step involves a transparent and inclusive re-evaluation of the recent pension reform, addressing the specific concerns raised by the protesting public, such as commission structures and mandatory contributions. Beyond legislative tweaks, fostering a culture of financial literacy and long-term planning is paramount. This means empowering citizens with the knowledge to make informed decisions about their savings, rather than solely relying on government directives or the allure of quick cash. Diversifying investment options within the pension system and strengthening regulatory oversight could also enhance fund performance and security. Ultimately, rebuilding Peru's retirement nest egg demands a commitment from both the government and its citizens to prioritize collective well-being over short-term political gains, ensuring future generations don't inherit an empty promise.

Related Articles

The Great Meat Debate: Reconciling Paraguay's Export Prowess with Local Plates

The Great Meat Debate: Reconciling Paraguay's Export Prowess with Local Plates

Harvesting Inequality: Argentina's Rural Workers Fight for Dignity Amidst Abundance

Harvesting Inequality: Argentina's Rural Workers Fight for Dignity Amidst Abundance

From Bricks to Balance: The Overlooked Economic Roots of True Well-being

From Bricks to Balance: The Overlooked Economic Roots of True Well-being

From Pillars to Dust: CREA's Downfall and the Cooperative Sector's Reckoning