Harvesting Resilience: Vietnam's Pepper Market Charts an Independent Course

Unpack Vietnam's distinct pepper price trends. Discover key factors like low stock, strategic imports & tariff advantages shaping its market resilience.

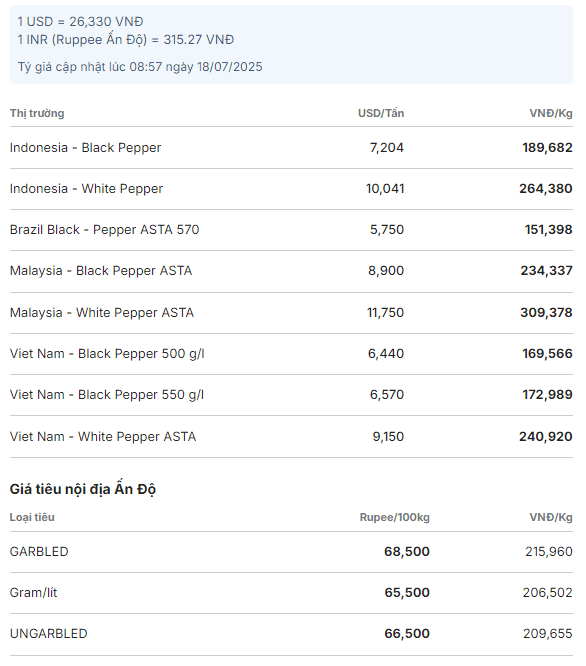

The Daily Grind: A Snapshot of Current Pepper Prices

Vietnam's pepper market, often a bellwether for global trends, presents a nuanced picture as of mid-July 2025. Domestic prices are holding firm, with key growing regions like and seeing prices at 139,000 VND per kilogram. Across the country, the lowest recorded price sits at 138,000 VND/kg, indicating a generally stable floor. This stability, however, follows a week of slight contractions, with prices softening by 1,000 to 3,000 VND/kg compared to the previous week, and a minor dip of 1,000 VND/kg noted in some localities just yesterday.

Internationally, the provides further context. While 's white and black pepper prices have seen declines and 's black pepper remains unchanged, Vietnam's listed white and black pepper prices are holding steady. Vietnamese white pepper, for instance, is quoted at a robust 9,150 USD per metric ton. This contrasts with Lampung black pepper from Indonesia at 7,204 USD/ton and Brazil's ASTA 570 black pepper at 5,750 USD/ton. 's Kuching ASTA black pepper also maintains stability at 8,900 USD/ton. The overall global trend, as observed by the IPC, leans towards a general decline, making Vietnam's relative stability particularly noteworthy.

Against the Grain: Vietnam's Unique Market Trajectory

Amidst a global pepper market generally grappling with downward pressure, Vietnam's trajectory stands out, displaying a remarkable degree of resilience. While the International Pepper Community notes a prevailing global decline, particularly affecting major exporters like Indonesia and Brazil, Vietnamese pepper prices, both domestic and international, have largely maintained their ground. This isn't to say the market has seen a dramatic surge; indeed, analysts suggest a sideways trend might persist in the short term, as no single powerful catalyst has emerged to propel domestic prices significantly higher.

However, this stability is a testament to unique underlying dynamics. Unlike some global counterparts, Vietnam's export volumes have remained consistently strong, indicating robust international demand for its product. A critical factor underpinning this unusual stability is the nation's domestic supply situation, which currently faces significant challenges. With local inventories at historically low levels—a five to six-year low, in fact—and the next harvest still eight months away, Vietnam finds itself in the curious position of being a major exporter that also needs to increase imports. This strategic reliance on imports, primarily from Brazil, Cambodia, and Indonesia, helps balance the domestic shortfall and ensures Vietnam can continue to meet its export commitments, effectively insulating its market from some of the wider global volatility.

Domestic Currents: Supply, Farmer Strategies, and Inventory Woes

The bedrock of Vietnam's distinctive market performance lies in its intricate domestic supply dynamics, which are currently dominated by significant inventory woes. We're talking about pepper stocks at an unprecedented five to six-year low, a stark reality when considering the next major harvest is still a distant eight months away. This scarcity is a primary driver behind the domestic market's sustained high prices, even as global trends waver. To bridge this gap and fulfill international commitments, Vietnam has actively ramped up its pepper imports, with , , and emerging as the leading suppliers. It's a pragmatic move that underscores the severe domestic supply deficit.

This tight supply has spurred a proactive response from Vietnamese export enterprises. Recognizing the imperative to meet their Q3 2025 orders, these companies are strategically accumulating stock, further bolstering demand within the local market. This aggressive procurement helps keep domestic prices elevated, creating a somewhat insulated environment. Farmers, meanwhile, are closely watching these developments. Despite recent minor price corrections, there's an underlying current of optimism, with many holding out for prices to rebound to earlier, more lucrative levels. Their selling strategies, often influenced by these expectations and the perceived scarcity, also play a role in managing the flow of pepper into the market, contributing to the overall tight supply situation.

Global Chessboard: Trade Winds and Tariff Advantages

Stepping onto the global chessboard, Vietnam's pepper market finds itself navigating complex trade winds, particularly those emanating from the , the world's largest importer and consumer of pepper. The unpredictable nature of US tariff policies is undeniably shaping market sentiment. In a recent significant move, the US announced exceptionally high reciprocal tariffs on key pepper-producing nations: a staggering 50% on Brazil and 32% on Indonesia. These aren't isolated incidents, with anticipated tariffs also targeting Malaysia at 25%, Sri Lanka at 30%, and Mexico at 30%.

This strategic realignment of global trade duties presents a remarkable competitive advantage for Vietnamese pepper. While other major exporters face substantial barriers to the lucrative US market, Vietnam is projected to receive more favorable tariff treatment. This preferential access is a game-changer, positioning Vietnamese pepper as a more attractive and cost-effective option for American buyers. Coupled with a broader trend of declining production in several other major exporting countries, this tariff disparity provides a powerful tailwind for Vietnam. It not only reinforces the demand for Vietnamese pepper but also helps to sustain its higher domestic prices, as exporters are keen to secure supply to capitalize on these new market dynamics. This global policy shift is, in essence, creating a distinct pathway for Vietnam's pepper trade, allowing it to bypass some of the global market's general downturn.

Looking Ahead: Cultivating Stability in an Unpredictable Market

Looking ahead, the Vietnamese pepper market appears poised to continue its resilient trajectory, cultivating a degree of stability even in an inherently unpredictable global landscape. In the short term, domestic prices are expected to remain elevated. This is largely due to the persistently low inventory levels and the concerted efforts by export companies to consolidate stock in anticipation of robust Q3 2025 orders. The current scenario suggests that the underlying fundamentals—tight supply and strong export demand—will continue to provide a firm floor for prices.

Beyond the immediate horizon, several factors could lend further support to the market in the medium to long term. Analysts are keenly observing the potential for a recovery in international consumer demand, which, after a subdued first half of the year, could inject significant positive momentum. Crucially, adverse weather conditions in competing pepper-producing nations like Brazil and Indonesia could severely impact their supply, further enhancing Vietnam's market position. While Vietnam's pepper exports have so far remained stable without a dramatic price surge, the combination of internal supply constraints and external tariff advantages hints at a sustained period of favorable conditions. For stakeholders navigating this market, prioritizing safe trading strategies remains prudent, ensuring they can capitalize on Vietnam's unique strengths while mitigating risks from wider global fluctuations. The narrative for Vietnamese pepper is clearly one of strategic independence and adaptive resilience.

Related Articles

The Pepper Anomaly: Decoding Vietnam's Unshaken Market in a Shifting Global Landscape

The Pepper Anomaly: Decoding Vietnam's Unshaken Market in a Shifting Global Landscape

The Unfolding Pepper Saga: Unpacking Vietnam's Climb to Record Highs

The Unfolding Pepper Saga: Unpacking Vietnam's Climb to Record Highs

Pepper's Paradox: Decoding the Disparity in Global Spice Trade

Pepper's Paradox: Decoding the Disparity in Global Spice Trade

Coffee's August Surge: Decoding the Market's Unpredictable Brew