Pepper's Paradox: Decoding the Disparity in Global Spice Trade

Explore the global pepper paradox: why high production doesn't always translate to higher international trade. Uncover the forces shaping this volatile spice market.

Unraveling the Global Pepper Landscape: Production vs. Trade Realities

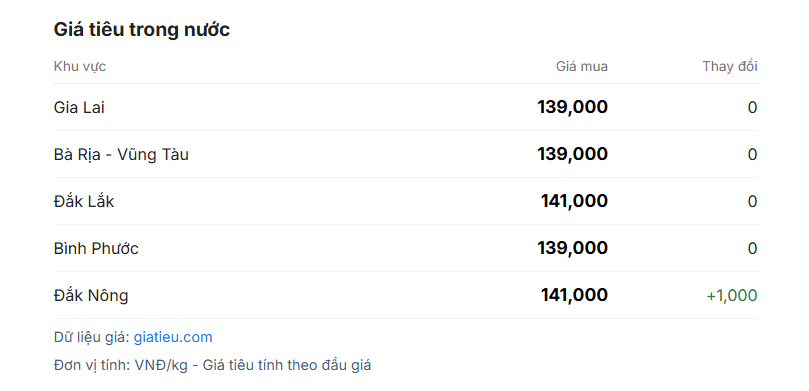

The global pepper market presents a fascinating dichotomy: while production figures paint one picture, the actual volumes traded internationally often tell a different story. In , for instance, domestic pepper prices saw an uptick, reaching 139,000 - 141,000 VND per kilogram in Đắk Lắk by early August 2025, with the also noting price increases in . However, a closer look reveals a more complex narrative. pepper exports experienced a decline in the first half of 2025, contrasting with growth seen in and . Despite this dip in export volume, managed to ship a substantial 145,046 tons of various pepper types in the first seven months of the year, generating nearly a billion dollars in revenue, with the remaining its primary destination. This paradox is further highlighted by the 's forecast of a 7.8% drop in 2025 pepper output, marking the third consecutive year of decline. Overall global production is also projected to shrink, primarily due to reductions in key producers like and , even as reports an increase. This intricate balance of fluctuating production and shifting trade flows sets the stage for understanding the true forces at play.

The Home Front Advantage: How Domestic Consumption Shapes International Supply

The disparity between global pepper production and international trade volumes is often rooted in the significant domestic consumption within key producing nations. While specific figures for internal consumption are not always publicly detailed, the observed export patterns strongly hint at this dynamic. For example, despite pepper output shrinking for the third year in a row, its substantial domestic market often absorbs a considerable portion of the harvest. This internal demand can limit the surplus available for export, even for a global powerhouse like . Interestingly, itself has become a major importer of pepper from , bringing in over 17,700 tons in the first seven months of 2025 alone – a staggering 177% increase from the previous year. This strategic import suggests that Vietnamese enterprises might be supplementing their supply to meet both internal processing needs and international export commitments, effectively mediating the global supply chain. This 'home front advantage' dynamic means that even if a country boasts high production, a strong internal market can dramatically reduce its net exportable surplus, thereby tightening global supply and influencing international prices.

Market's Pulse: Factors Driving Pepper Price Volatility and Trader Sentiment

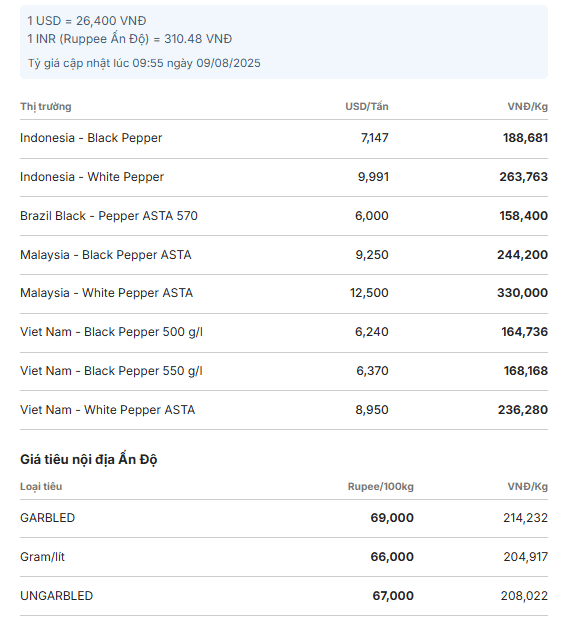

Pepper prices are notoriously volatile, a characteristic driven by a confluence of supply-demand fundamentals, policy shifts, and the often-unpredictable psychology of traders. Globally, black pepper prices from hover around $6,240-$6,370 per ton, while white pepper commands a premium at $8,950 per ton. Other origins like , , and also show varied pricing, with the noting recent upticks in and prices. The stark difference in price trends between black and white pepper in July 2025, where white pepper surged by nearly $300/ton while black pepper saw a slight dip, underscores a key market insight: white pepper, being a smaller segment of the total export volume (12-15%), is less susceptible to speculative pressures, leading to greater price stability. Looking ahead, white pepper prices are anticipated to remain elevated if European demand continues to climb and supply remains constrained. However, the market's sensitive nature means that favorable weather leading to increased yields or a collective decision by businesses to release stored inventory could temper any sharp price increases, highlighting the delicate balance traders constantly navigate.

Vietnam's Dominance: A Deep Dive into Export Dynamics and Market Influence

position as a dominant force in the global pepper market is undeniable, even in the face of domestic production challenges. While the country's own output has been on a downward trend for several years, its robust export infrastructure and strategic market maneuvers allow it to maintain significant influence. In the first seven months of 2025, exported an impressive 145,046 tons of pepper, solidifying its role as a key global supplier. What’s particularly insightful is evolving relationship with other producing nations. It has emerged as largest pepper export destination, importing over 17,700 tons in the first seven months of 2025. This substantial import volume suggests a sophisticated strategy: might be sourcing raw material from to meet its processing and re-export commitments, or to bolster its domestic supply amidst declining local harvests. This dynamic not only benefits Brazilian growers but also allows to manage its supply chain effectively, ensuring it can continue to cater to major markets like the , its largest export partner. This proactive approach to sourcing and trading underscores enduring market power, showcasing its ability to adapt and influence global pepper flows despite internal production shifts.

Future Harvests: Navigating Challenges and Opportunities in the Global Pepper Market

As we look towards future harvests, the global pepper market faces a dual landscape of persistent challenges and emerging opportunities. The most pressing challenge remains the consistent decline in production from major origins like , , and , which has led to tighter global supply. projected 7.8% production drop in 2025, marking its third consecutive annual decline, exemplifies this trend. However, amidst these supply constraints, opportunities are ripe for the taking. Strong demand from key import markets, particularly , is expected to keep white pepper prices elevated through the latter half of 2025. Furthermore, the market anticipates a significant increase in orders during Q4 2025 and Q1 2026, as importers stock up for peak consumption periods. The market's future trajectory will largely depend on a delicate interplay of factors: favorable weather conditions could boost production and ease supply pressures, while strategic inventory releases by major enterprises could also help stabilize prices. Success in this evolving market will hinge on the adaptability of producers and traders, requiring keen awareness of policy shifts, market sentiment, and collaborative efforts to ensure a sustainable and stable global pepper supply chain.

Related Articles

The Unfolding Pepper Saga: Unpacking Vietnam's Climb to Record Highs

The Unfolding Pepper Saga: Unpacking Vietnam's Climb to Record Highs

Harvesting Resilience: Vietnam's Pepper Market Charts an Independent Course

Harvesting Resilience: Vietnam's Pepper Market Charts an Independent Course

The Pepper Anomaly: Decoding Vietnam's Unshaken Market in a Shifting Global Landscape

The Pepper Anomaly: Decoding Vietnam's Unshaken Market in a Shifting Global Landscape

The Great Coffee Contradiction: Supply Fears Meet Surplus Forecasts