The Digital Fortress: Inside DIAN's Bold Tech Strategy for a Flawless Tax Season

DIAN unveils major tech upgrades to its Muisca platform. Learn how new resilience, monitoring, and tools ensure a smooth, secure tax season for 6.7M Colombians.

From Past Challenges to Future Promise: DIAN's Tech Vow

Colombia's tax authority, , has embarked on an ambitious technological overhaul, signaling a significant shift in its approach to the annual income tax declaration season. For many citizens, this period has historically been synonymous with digital bottlenecks, system crashes, and considerable frustration. Recognizing these deep-seated challenges, DIAN is proactively investing in its core digital infrastructure, particularly the system, to ensure a smoother, more reliable experience for the millions of natural persons expected to file their declarations. This isn't just a minor tweak; it's a comprehensive strategic pivot. , DIAN's acting general director, articulated this commitment, explaining that institutional efforts have been intensely focused on fortifying the technological platform. The goal is clear: to robustly navigate the upcoming deadlines, transforming a traditionally daunting task into a seamless digital journey. This proactive stance hints at a future where tax compliance is less about navigating system failures and more about efficient, user-centric processes.

Engineering Resilience: Under the Hood of MUISCA's Transformation

The promise of a flawless tax season isn't built on wishful thinking; it's grounded in a meticulous engineering strategy aimed at bolstering the system's core resilience. 's technical teams have been busy implementing a suite of robust measures designed to prevent the system slowdowns and outages that have plagued past declaration periods. This includes the deployment of continuous monitoring schemes, allowing for real-time oversight of system performance and early detection of potential issues. Rigorous load testing has been conducted to simulate peak demand scenarios, ensuring the infrastructure can handle millions of concurrent users without faltering. Capacity adjustments have been made, and significant improvements rolled out across production environments. Crucially, DIAN has reinforced its failure recovery protocols, meaning that even if an incident occurs, the system can quickly and efficiently rebound. acknowledged that no technological ecosystem is entirely immune to incidents, but these actions are specifically designed to mitigate risks of widespread disruption and ensure operational continuity, especially during high-demand peaks. Furthermore, continuous accompaniment from responsible technology operators will provide timely responses to any critical incidents, adding another layer of assurance.

Empowering Taxpayers: Navigating Your Declaration with New Tools

Beyond the significant infrastructure upgrades, is actively empowering taxpayers with a suite of intuitive digital tools designed to simplify the declaration process. This user-centric approach aims to demystify tax filing and reduce common errors. Among the standout new features is a dedicated search engine, allowing individuals to quickly ascertain their obligation to declare income simply by entering their national identification number. This addresses a common point of confusion right at the outset. Furthermore, taxpayers can now easily access and download their "exógena" information—data reported by third parties—directly from DIAN's platform. This pre-populated information significantly streamlines form completion, minimizing manual entry and potential mistakes. Another valuable addition is the detailed report of electronic invoices issued in the taxpayer's name during 2023, facilitating the calculation of the 1% deduction for purchases where applicable. While these tools significantly enhance the user experience, it's worth noting that the updated pre-validator tool, crucial for many filings, is currently not compatible with mobile devices, Linux, or Mac OS, a detail users should keep in mind as the declaration period commences on August 12 and extends through October 24, 2025.

Beyond the Deadline: A New Chapter for Digital Tax Compliance

As the 2025 tax season unfolds, 's comprehensive technological overhaul represents more than just a temporary fix; it marks the beginning of a new chapter for digital tax compliance in . The strategic investments in system resilience, real-time monitoring, and user-friendly tools are fundamentally reshaping the relationship between the tax authority and its citizens. The aim is to transition the annual income declaration from a source of anxiety and operational strain into a reliable, efficient, and even predictable process. This proactive vision extends beyond simply surviving the peak filing period; it's about fostering an environment where digital interaction with the tax system becomes a seamless part of civic life. By mitigating the risk of mass disruptions and ensuring continuous operational service, DIAN is building trust and encouraging greater adherence to tax obligations. The ongoing commitment to monitoring and improvement, coupled with dedicated support from technology partners, suggests a long-term strategy for maintaining a robust and adaptable digital fortress. This isn't just about meeting deadlines; it's about setting a new standard for national digital infrastructure and proving that a complex administrative task can indeed be transformed into an efficient, user-centric experience for millions.

Related Articles

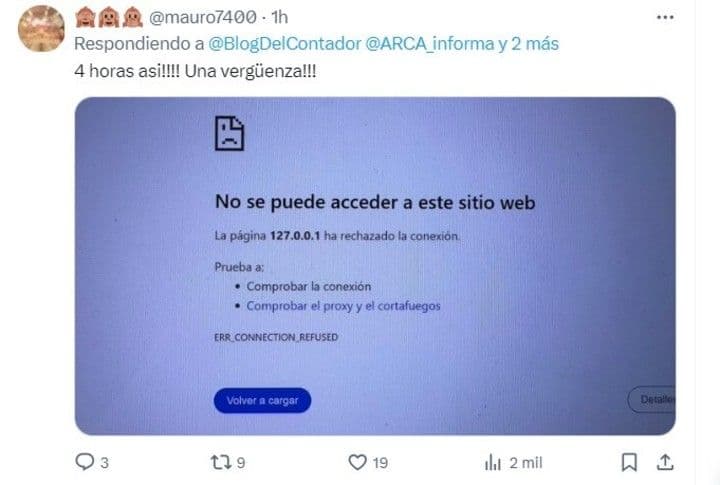

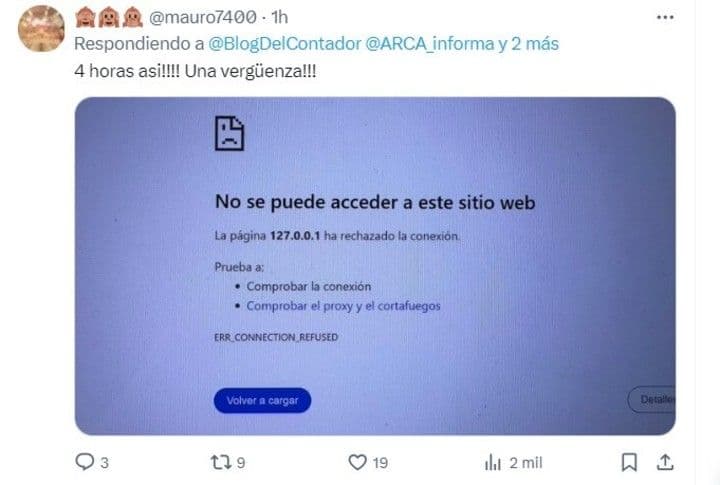

The Digital Abyss: ARCA's System Meltdown Traps Taxpayers in Uncertainty

The Digital Abyss: ARCA's System Meltdown Traps Taxpayers in Uncertainty

Digital Sentinels on Chilean Roads: The Promise and Paradox of Ley CATI

Digital Sentinels on Chilean Roads: The Promise and Paradox of Ley CATI

The Disposable Income Dividend: Vietnam's Bold Move to Revitalize Personal Finances

The Disposable Income Dividend: Vietnam's Bold Move to Revitalize Personal Finances

Unlocking the Digital Frontier: Argentina's Blueprint for Modern Trade