The Digital Abyss: ARCA's System Meltdown Traps Taxpayers in Uncertainty

Argentina's tax agency, ARCA, faces a major online breakdown. Discover the impact on taxpayers, critical Monotributo deadlines, and the broader implications for digital governance.

A Nation Logged Out: The ARCA Crisis Unfolds

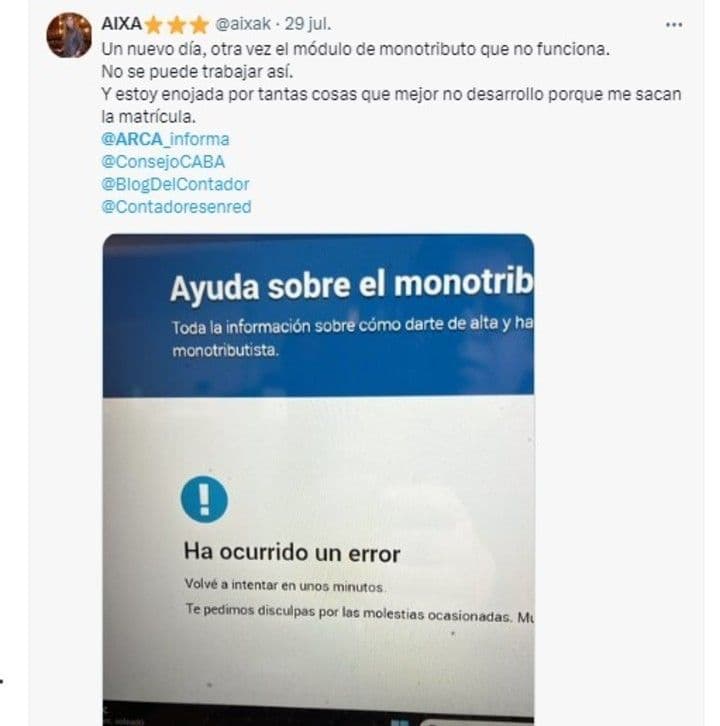

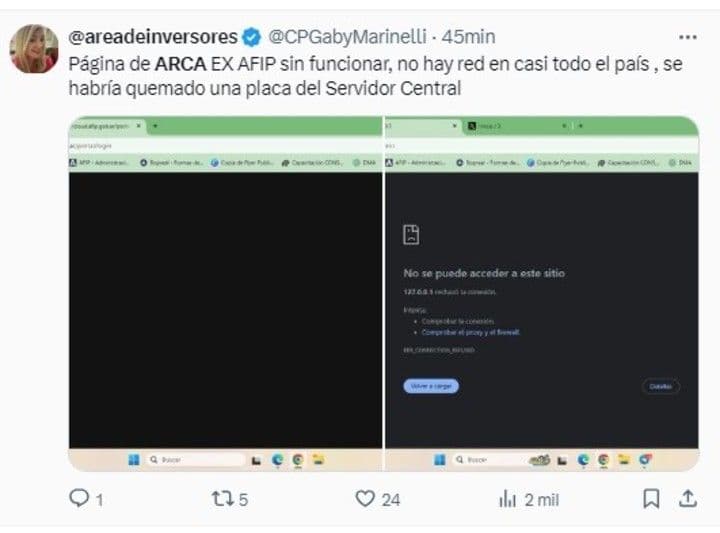

A palpable wave of frustration is sweeping across the nation as , the Agencia de Recaudación y Control Aduanera – the new face of Argentina’s tax administration, replacing the long-standing AFIP – finds its digital backbone buckling under pressure. What appears, at first glance, to be a perfectly normal homepage quickly devolves into a digital void for countless taxpayers. The moment one attempts to log in, the portal collapses, leaving users stranded in a 'page down' error. This systemic collapse, which began subtly on Tuesday but exploded into a full-blown crisis by Wednesday, forced to issue a terse alert on its X (formerly Twitter) account: "Momentarily we are experiencing problems with ARCA systems. We are working to activate it as soon as possible." This vague assurance, devoid of any estimated recovery time or explanation for the outage – whether it's an internal glitch, a system update, or a cyberattack – has only intensified the public's anxiety. Accountants, already racing against tight month-end deadlines, and ordinary citizens are voicing their outrage across social media, with one prominent voice, 'Blog del Contador,' sarcastically asking, "Is anyone going to give a logical explanation at some point about the disaster that is this page?" The digital gateway to essential tax compliance has slammed shut, trapping millions in an unforeseen limbo.

The Deadline Dilemma: Monotributo's Unmet Mandate

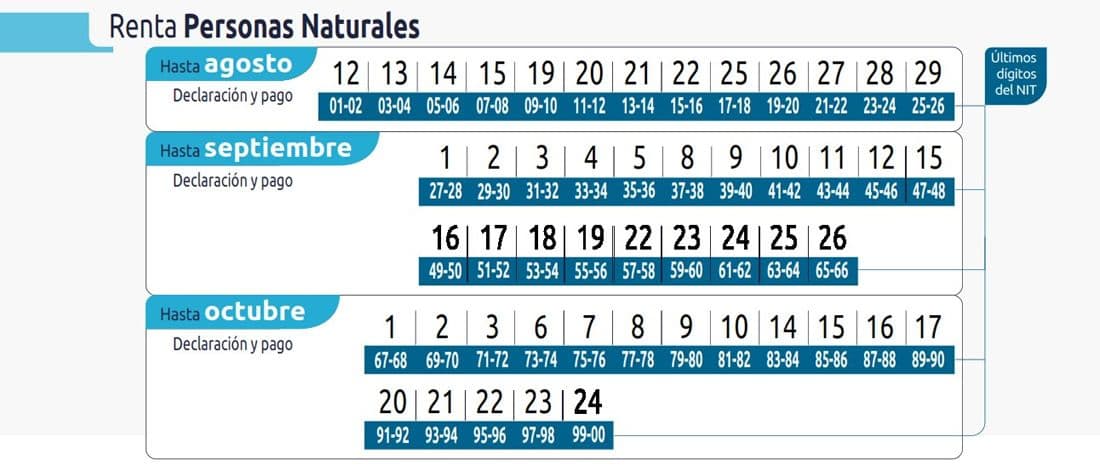

The timing of 's digital meltdown couldn't be worse, plunging thousands of Monotributo taxpayers into a high-stakes 'digital limbo' as a critical recategorization deadline looms large. This essential process, open from July 15th to August 5th, requires a vast segment of independent workers and small businesses to update their income data over the past 12 months, ensuring they are placed in the correct tax bracket. Failing to do so can lead to automatic reclassification or even penalties from the tax authority. Ironically, just hours before its systems crashed, itself issued a reminder about the approaching August 5th deadline, a move that now strikes many as a cruel joke given the current inaccessibility. The agency's website, which normally provides a step-by-step guide for this vital process, remains an impenetrable barrier. While not every Monotributo taxpayer needs to recategorize, those who have seen their income change significantly are now caught between a rock and a hard place: a mandatory process they cannot complete and the looming threat of sanctions if they fail to comply. The clock is ticking, and the portal remains unresponsive.

Silence from the Source: ARCA's Vague Assurance and Lingering Questions

In the face of widespread digital paralysis, 's official response has done little to quell the mounting frustration, instead fueling a deeper sense of mistrust. Their brief statement on X, promising to restore systems "as soon as possible," has become a recurring point of contention. What does "as soon as possible" actually mean for taxpayers with a mere six days left until a critical deadline? The agency has conspicuously failed to provide an estimated time for normalization, leaving citizens and professionals in an agonizing state of uncertainty. More critically, has offered no explanation for the system failure itself. Is it an internal technical glitch, a planned but botched system update, or perhaps a more sinister external cyberattack? This lack of transparency is a major concern. Without understanding the root cause, it's impossible to gauge the severity of the problem or the likelihood of a swift resolution. The silence from the source, punctuated only by vague reassurances, amplifies the public's exasperation and reinforces the perception of an unresponsive bureaucracy. The collective cry for a "logical explanation" echoes across social media, yet remains unanswered.

The Wider Ripple: Trust, Technology, and Tax Compliance

Beyond the immediate inconvenience, 's prolonged system failure sends unsettling ripples through the broader landscape of digital governance and taxpayer trust. In an era where governments increasingly push for online tax administration, such a fundamental breakdown exposes the inherent vulnerabilities of relying entirely on digital infrastructure for critical civic duties. When citizens cannot access essential services, especially those tied to legal obligations like tax compliance, it erodes their confidence not just in the specific agency, but in the entire digital transformation agenda. The frustration isn't merely about a missed deadline; it’s about the perceived inability of a governmental body to ensure basic functionality and transparent communication. How can taxpayers be expected to comply meticulously with regulations when the very tools provided for compliance are unreliable? This incident risks fostering a climate of cynicism, where the convenience promised by digitalization is overshadowed by the very real threat of 'digital limbo.' It’s a stark reminder that robust technological foundations and clear communication are paramount for maintaining public trust and ensuring the seamless functioning of a modern tax system.

Navigating the Impasse: What's Next for Frustrated Filers?

As the Monotributo recategorization deadline of August 5th inches closer, frustrated filers are left in an unenviable position, grappling with uncertainty and the threat of penalties. The step-by-step guide to recategorization, usually a beacon for compliance, remains an inaccessible fantasy. So, what steps can taxpayers and accountants take while 's systems remain inoperative? At present, practical options are limited. Most professionals advise diligently documenting all attempts to access the system, including screenshots and timestamps, as proof of good faith. This might serve as a defense should attempt to impose sanctions for non-compliance. The most critical next step, however, must come from itself. Taxpayers urgently need an official extension of the recategorization deadline. Without it, many will face automatic reclassification or fines through no fault of their own. Furthermore, clear communication about the cause of the outage and a firm timeline for resolution are essential to restore some semblance of order and trust. Until then, citizens and their financial advisors remain caught in this digital quagmire, hoping for a swift and equitable resolution to a crisis that should never have reached this scale.

Related Articles

The Digital Fortress: Inside DIAN's Bold Tech Strategy for a Flawless Tax Season

The Digital Fortress: Inside DIAN's Bold Tech Strategy for a Flawless Tax Season

The Unseen Pillars of Finance: When a Glitch Unsettles Trust and Balances

The Unseen Pillars of Finance: When a Glitch Unsettles Trust and Balances

The $800 Riddle: Unpacking the Global Freeze on Small Package Shipments to the U.S.

The $800 Riddle: Unpacking the Global Freeze on Small Package Shipments to the U.S.

Argentina's Unpaved Promise: The High Stakes Driving La Rural's Critical Dialogue