The Unseen Pillars of Finance: When a Glitch Unsettles Trust and Balances

A recent Hungarian bank glitch revealed the unseen layers of digital finance. Uncover the OFSZ system error, its wide impact, and critical lessons for trust in modern payments.

The Day Our Digital Wallets Wavered

A seemingly ordinary Thursday morning recently turned into a moment of collective anxiety for tens of thousands of Hungarian bank customers. Without warning, their digital wallets began to show bewildering duplicate charges for card purchases, transfers, and direct debits. Customers of major banks like and were among the first to notice these unsettling discrepancies appearing on their account statements. The initial confusion quickly morphed into concern as the phenomenon spread, raising questions about the security and reliability of everyday financial transactions. Banks, quick to respond to the growing unease on social media and their official channels, immediately sought to reassure their clientele. They emphatically stated that no money had been lost and that all affected sums would be returned. This immediate communication was crucial, aimed at stemming the tide of panic and reinforcing consumer trust during an unexpected system anomaly. The incident served as a stark reminder of how deeply integrated digital finance has become into our daily lives, and how quickly a technical hiccup can unsettle the sense of financial security we often take for granted.

Beyond the Bank: Unmasking the Core of the Glitch

While the double charges appeared on bank statements, both OTP and Erste were quick to clarify that the root of the problem lay not within their own systems, but with an external service provider. Investigative reports soon pinpointed the culprit: the , or (Országos Fizetési Szolgáltató). It turns out, the central system operated by OFSZ had suffered a faulty database issue, erroneously resending certain transaction data to the banks. Given the inherent design of banking systems, which are highly sensitive to central data flows and mandated to process every incoming transaction for security purposes, these re-sent messages were automatically processed again, triggering the duplicate debits. OFSZ later described this as a “marginal IT error,” emphasizing their decade-long, unblemished relationship with the processing service provider responsible. They also highlighted that this was a singular event, unprecedented in their operational history. However, the precise number of affected customers and transaction details remained undisclosed, citing payment secrecy regulations.

The Ripple Effect: Understanding Systemic Fragility

What the OFSZ characterized as a 'marginal' error quickly revealed a profound systemic fragility within 's financial infrastructure. Despite its seemingly isolated origin in a central database, the glitch rapidly propagated, affecting not just one but multiple major banks and, by extension, tens of thousands of customers. This incident underscores a critical aspect of modern payment systems: their interconnectedness. When a central hub, like OFSZ, experiences a data integrity issue, the ripple effect is almost instantaneous and widespread. The very security protocols that mandate banks to process all incoming transaction data, designed to prevent fraud and ensure completeness, paradoxically became a vector for the erroneous duplicate charges. It's a delicate balance: robust security measures must be in place, yet they also amplify the impact of errors at key points in the chain. This event serves as a potent reminder that even a small flaw at a central processing level can cause significant disruption across an entire financial ecosystem, momentarily shaking public confidence and highlighting the unseen, complex layers that underpin our daily digital transactions.

Restoring the Ledger: How Errors Are Undone

As unsettling as the double debits were, the system's inherent mechanisms for error correction quickly kicked into gear, demonstrating a crucial layer of resilience. When the initial erroneous transaction message was received, banks would typically place a hold on the funds and notify the customer of a deduction. However, in this specific scenario, the funds weren't actually transferred to the merchant due to the underlying error in the first message. Once the corrected, or second, message from OFSZ was processed – which typically happened by the next business day – the banks' accounting systems automatically recognized the discrepancy. This allowed them to reverse the provisional charge, effectively releasing the locked funds and restoring the customer's original available balance. OFSZ confirmed they initiated immediate action upon understanding the technical fault from their processing provider, informing affected banks to manage the situation. They also reassured the public that the credit for erroneous transactions would be automatic, requiring no special action or complaint from customers. While most refunds were expected within one to two business days, larger or international transactions might take a little longer to fully reconcile, illustrating the multi-faceted nature of digital financial recovery.

Navigating the Digital Economy: Lessons for Future Trust

The Hungarian double-charge incident, while resolved swiftly, offers valuable lessons for both consumers and the broader financial industry in our increasingly digital economy. It pulls back the curtain on the critical, yet often invisible, role played by central entities like the (). Most of us interact directly with our banks, unaware of the intricate web of intermediaries that facilitate every card swipe or online transfer. This event highlights that trust isn't just in your bank; it extends to every component of the payment infrastructure. For consumers, the takeaway is clear: regularly checking bank statements isn't just good practice, it's a vital safeguard. For financial institutions and central service providers, the emphasis must be on robust system resilience, rigorous testing protocols, and transparent communication during crises. While OFSZ termed it a 'marginal' error, its widespread impact on public perception underscores that any glitch, regardless of its technical classification, can unsettle the bedrock of trust that underpins the digital economy. Building and maintaining that trust requires continuous vigilance, investment in secure infrastructure, and a commitment to clear, timely information, even when sensitive data is involved.

Related Articles

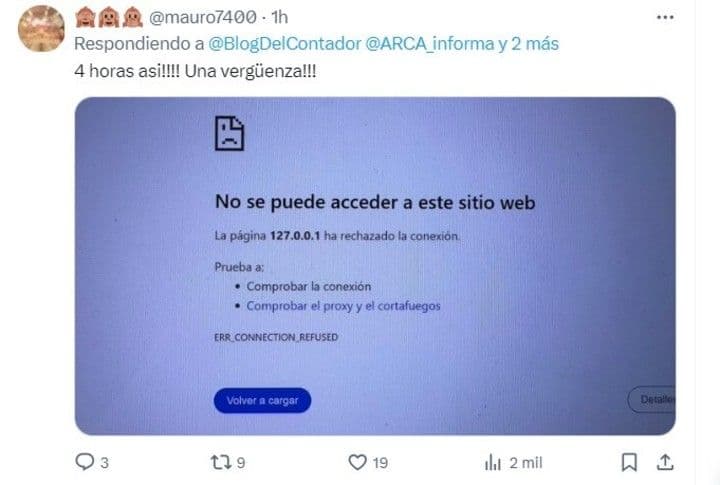

The Digital Abyss: ARCA's System Meltdown Traps Taxpayers in Uncertainty

The Digital Abyss: ARCA's System Meltdown Traps Taxpayers in Uncertainty

The Unsettling Tide: Navigating Trust and Transparency in the Wake of the eFishery Scandal

The Unsettling Tide: Navigating Trust and Transparency in the Wake of the eFishery Scandal

Forging Europe's Financial Future: Wero's Bid for Digital Sovereignty

Forging Europe's Financial Future: Wero's Bid for Digital Sovereignty

Beyond the Label: Unpacking the Auchan Water Recall and the Price of Trust